Life of ease:

Though we as humans are designed to be very active in our life, there are many situations or instances which make us to choose to be lazy as a bone. In such cases, we tend not to actively do anything and the best name to describe this condition is the couch potato. Some of us are so used to be very lethargic and needing comfort and convenience all the time. They are so adamant not to get out even to buy a simple thing for themselves or the family and are always on the lookout for someone who would do the job for him. Taking this into mind of the consumers, and studying their behaviour many brands have come up with ingenious ideas and innovative financing services that will make this happen. In the past few decades, the developed countries had devised a home delivery system which is practised even today but the medium of booking the item you want has changed from fat, glossy and attractive books which can be used to purchase the required things. This has been carried out as a big business today with the help of the internet. We have become more of victims of this life of ease that we tend to forget that the fund provider is not a parent who would excuse you the entire amount that he credited into your account .

.

To be alert!

You know that sometime or the other the creditor has to ask for the money back at least in regular intervals if not all at once. Those glossy credit catalogues have been the reason for many people filing for bankruptcy and other such situations. The credit

has to ask for the money back at least in regular intervals if not all at once. Those glossy credit catalogues have been the reason for many people filing for bankruptcy and other such situations. The credit that is added into the account

that is added into the account does not end there but you have to return the interest that is charged on the amount you have loaned from the company. To avoid having stamped with a low credit score, you have to be alert all the time until the whole amount is given back. This will explain you as a good credit scorer and the chances of you getting more borrowings in the future is made positive.

does not end there but you have to return the interest that is charged on the amount you have loaned from the company. To avoid having stamped with a low credit score, you have to be alert all the time until the whole amount is given back. This will explain you as a good credit scorer and the chances of you getting more borrowings in the future is made positive.

Score big!

As far as the credit card method of payment is concerned, it is always better to score a big good credit taker rather than the other way. Those with a poor credit record find it difficult to borrow credit in the future

is concerned, it is always better to score a big good credit taker rather than the other way. Those with a poor credit record find it difficult to borrow credit in the future and the life of comfort gets very burdensome. So, score big by returning the amount with the utmost regularity.

and the life of comfort gets very burdensome. So, score big by returning the amount with the utmost regularity.

The stuff:

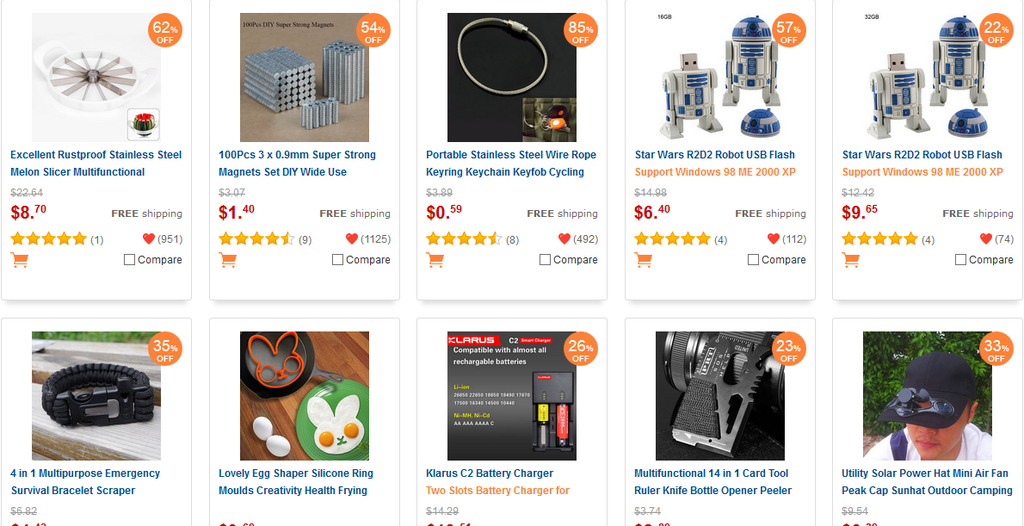

Credit eligible purchases include many of the household stuff such as the white goods, such as washing machines, deep freezers, vacuum cleaners and other electronic items such as the television, smart phones, computers, consoles, and many other and on top of it are the furniture items such as sofas, beds and others. There are other such goods which are related to children’s activities such as play stations and the like. Most of the high end brands give the credit facilities to the credit cards taken from reputed banks with worthy and quality customers.

such as play stations and the like. Most of the high end brands give the credit facilities to the credit cards taken from reputed banks with worthy and quality customers.

The stores:

There are many high end and reputed stores and premium brands that offer the credit purchase cards and the payment

purchase cards and the payment can be done over a few instalments. Some of the stores and brands also offer a relaxation of a certain percentage on payment

can be done over a few instalments. Some of the stores and brands also offer a relaxation of a certain percentage on payment if the customer buys on credit rather than cash. This would be very tempting to many and the catalogues for bad credit when the customer forgets his payment duties.

if the customer buys on credit rather than cash. This would be very tempting to many and the catalogues for bad credit when the customer forgets his payment duties.