Budgeting is the process of creating a plan to spend your money. This spending plan is called a budget. Simply put, it’s balancing your expenses with your income. If you spend more than you make, you’ll be in trouble. A lot of people are unaware that they spend more than they earn and before they know it, they have accumulated huge amounts of debt.

Budgeting is very important because it allows you to make a spending plan for your money. It guarantees that you’ll always have enough money for the things you need and the things that’re essential to you. Following a budget will also keep you out of debt or help you to work your way out of debt if you’re presently in debt. A good budget can help keep your spending on track and even reveal some concealed cash flow problems that might free up even more money to put toward your other financial goals.

But what if you’re already penniless? Budgeting strategies sound okay, but if you’re in a very difficult situation financially or suffering from mounting bills and a lack of funds, there’re some other possible steps to take. Here are ways to budget when you’re bankrupt:

A. Prioritize Bills

Go over all your bills to see what must be paid first and then set up a payment schedule based on your paydays. Leave yourself some catch-up time if some of your bills are already late. Ask the bill companies how much you can pay now to get back on track toward positive status. Be honest about the amount you can pay for.

B. Keep Away From Immediate Disaster

Request bill extensions or payment plans from creditors. Avoiding or delaying payments only worsens your debt.

C. Remove Unnecessary Expenses

All cutbacks should start with items you don’t really need or habits you should change anyway, like buying cigarettes and/or alcoholic drinks, and eating out instead of just preparing meals at home.

D. Review Spending

You need to manage your outlay first to restore your finances. Online banking and online budgeting software can help you categorize spending so you can make adjustments. According to Forbes Advisor (https://www.forbes.com/advisor/banking), the best budgeting app for monitoring daily activity is Mint, while the best app for tracking spending is PocketGuard (https://pocketguard.com/).

E. Find New Income

Consider ways to increase earnings like getting a second job, working overtime, and getting some freelance work.

F. Arrange Credit Card Interest Rates

Call the credit card company and ask for a decrease in the annual percentage rates (APR). If you have a good record, your request might be approved. This won’t lower your outstanding balance, but it will keep it from increasing as fast.

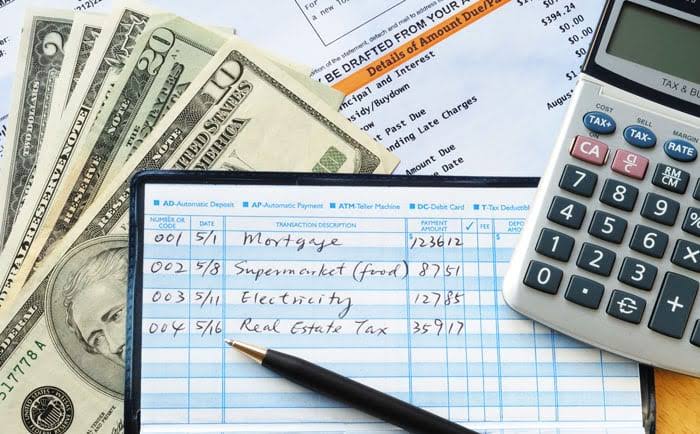

G. Maintain a Budget Journal

Write everything you spend in a notebook, through budgeting apps on your phone, or budgeting software. Focus on securing that every cent is accounted for by dividing your expenses into categories. Make improvements and adjust the spending as needed after each month.

Budgeting may sound complex but it can actually be a very basic personal finance skill. Whether you decide to make your budget bare bones or detailed to the last dollar, the most vital part of budgeting is to put it into practice. CLICK HERE to know more about budgeting.